The higher the number, the greater the reliance a company has on debt to fund growth. Your company owes a total of $350,000 in bank loan repayments, investor payments, etc. Increase revenue and use the new equity to either buy new assets or pay off existing debts. In fact apps shareholders can make more from projects funded by debt rather than equity. This is because the cost of debt is lower than the cost of equity – so the return on equity is better. All we need to do is find out the total liabilities and the total shareholders’ equity.

Retention of Company Ownership

Making smart financial decisions requires understanding a few key numbers. This number can tell you a lot about a company’s financial health and how it’s managing its money. Whether you’re an investor deciding where to put your money or a business owner trying to improve your operations, this number is crucial. This issue is particularly significant in sectors that rely heavily on preferred stock financing, such as real estate investment trusts (REITs).

- You could also replace the book equity found on the balance sheet with the market value of the company’s equity, called enterprise value, in the denominator, he says.

- Also, this ratio looks specifically at how much of a company’s assets are financed with debt.

- Understanding these distinctions is crucial for accurately interpreting a company’s financial obligations and overall leverage.

- As a highly regulated industry making large investments typically at a stable rate of return and generating a steady income stream, utilities borrow heavily and relatively cheaply.

- In fact shareholders can make more from projects funded by debt rather than equity.

Related Terms

A negative D/E ratio indicates that a company has more liabilities than its assets. This usually happens when a company is losing money and is not generating enough cash flow to cover its debts. The D/E ratio also gives analysts and investors an idea of how much risk a company is taking on by using debt to finance its operations and growth.

Personal Loans

In other industries, such as IT, which don’t require much capital, a high debt to equity ratio is a sign of great risk, and therefore, a much lower debt to equity ratio is more preferable. Total equity, on the other hand, refers to the total amount that investors have invested into the company, plus all its earnings, less it’s liabilities. A debt-to-equity ratio of 1.5 shows that the company uses slightly more debt than equity to stimulate growth. For every dollar in shareholders’ equity, the company owes $1.50 to creditors. A debt-to-equity ratio that is too high suggests the company may be relying too much on lending to fund operations. This makes investing in the company riskier, as the company is primarily funded by debt which must be repaid.

Financials

At first glance, this may seem good — after all, the company does not need to worry about paying creditors. Like the D/E ratio, all other gearing ratios must be examined in the context of the company’s industry and competitors. If a D/E ratio becomes negative, a company may have no choice but to file for bankruptcy. If the D/E ratio of a company is negative, it means the liabilities are greater than the assets. They may note that the company has a high D/E ratio and conclude that the risk is too high.

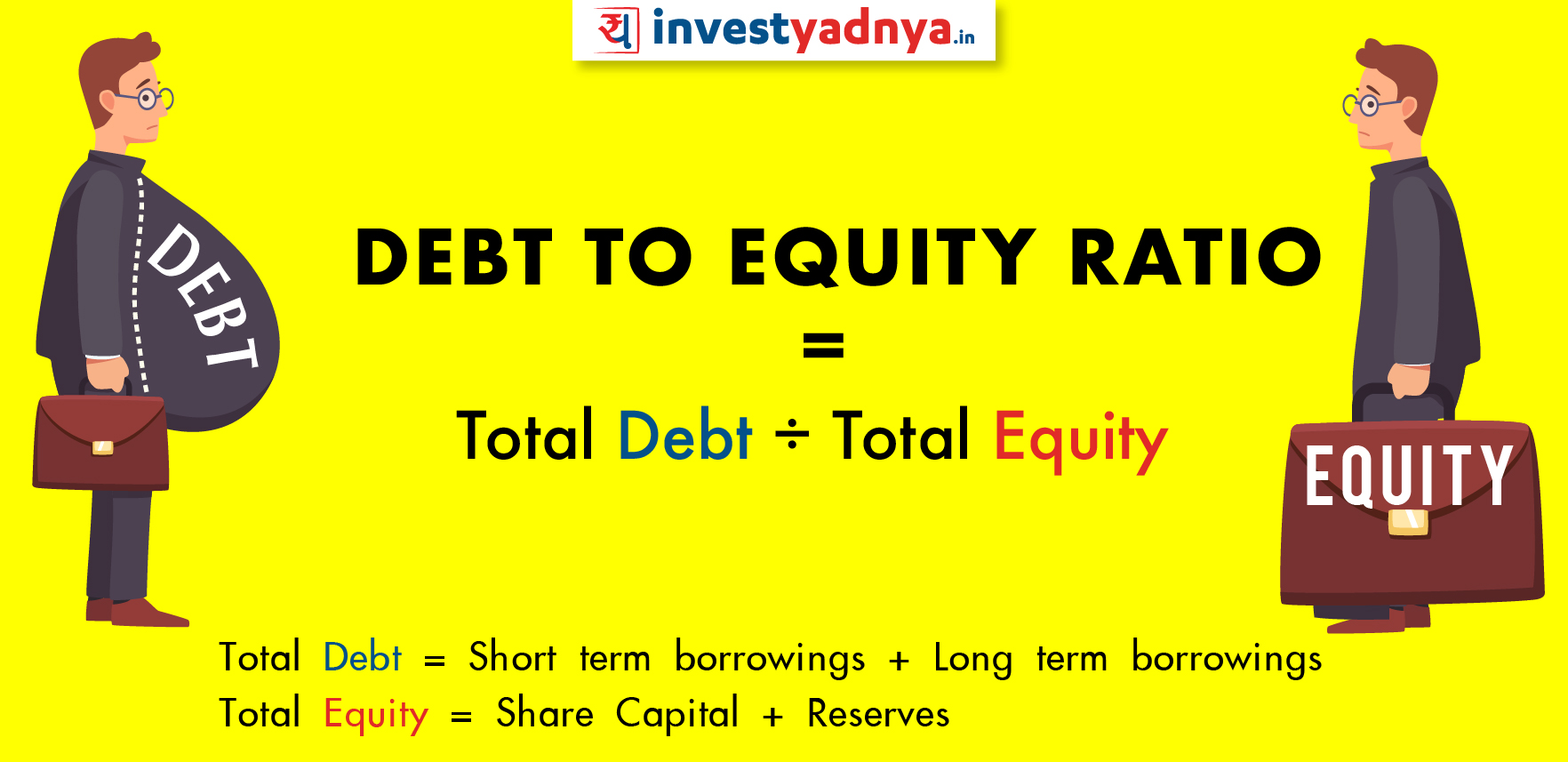

Debt to Equity Ratio Formula & Example

This ratio, calculated by dividing total liabilities by total assets, serves as a valuable tool for assessing a company’s financial stability, gauging risk exposure, and evaluating capital structure. Debt-to-equity is a gearing ratio comparing a company’s liabilities to its shareholder equity. Typical debt-to-equity ratios vary by industry, but companies often will borrow amounts that exceed their total equity in order to fuel growth, which can help maximize profits.

On the surface, this may sound like the debt ratio formula is the same as the debt-to-equity ratio formula. However, the total debt ratio formula includes short-term assets and liabilities as part of the equation, which the debt-to-equity ratio discounts. Also, this ratio looks specifically at how much of a company’s assets are financed with debt.

We have the debt to asset ratio calculator (especially useful for companies) and the debt to income ratio calculator (used for personal financial purposes). Sectors requiring heavy capital investment, such as industrials and utilities, generally have higher D/E ratios than service-based industries. A higher ratio may deter conservative investors, while those with a higher risk tolerance might see it as an opportunity for greater returns.

But utility companies have steady inflows of cash, and for that reason having a higher D/E may not spell higher risk. If preferred stock appears on the debt side of the equation, a company’s debt-to-equity ratio may look riskier. The term “leverage” reflects the hope that the company will be able to use a relatively small amount of debt to boost its growth and earnings. Wise use of debt can help companies build a good reputation with creditors, which, in turn, will allow them to borrow more money for potential future growth.

It’s advisable to consider currency-adjusted figures for a more accurate assessment. As established, a high D/E ratio points to a company that is more dependent on debt than its own capital, while a low D/E ratio indicates greater use of internal resources and minimal borrowing. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Different industries vary in D/E ratios because some industries may have intensive capital compared to others. If the D/E ratio gets too high, managers may issue more equity or buy back some of the outstanding debt to reduce the ratio.